About us

Taliti Funds SICAV is a collective investment scheme organised as a multi-fund company with variable share capital under the laws of the Republic of Malta with licence number SV 185. The Scheme is licensed by the Malta Financial Services Authority (the “MFSA”) on 2011 as a Professional Investor Fund (“PIF”) which is available to investors qualifying as Qualifying Investors. Taliti Funds SICAV offer you the possibility to rent and customize a compartment for your personal Professional Investor Fund and is addressed to small/medium size asset managers with alternative investment strategies.

Taliti Funds SICAV is a collective investment scheme organised as a multi-fund company with variable share capital under the laws of the Republic of Malta with licence number SV 185. The Scheme is licensed by the Malta Financial Services Authority (the “MFSA”) on 2011 as a Professional Investor Fund (“PIF”) which is available to investors qualifying as Qualifying Investors. Taliti Funds SICAV offer you the possibility to rent and customize a compartment for your personal Professional Investor Fund and is addressed to small/medium size asset managers with alternative investment strategies.

Our Services

We offer you the possibility to rent and customize a compartment for your Professional Investor Fund in our existing SICAV.

Setup

Setup

Design and implementation of the optimal fund structure depending on the client’s requirements (name, type of investors, timeline, investment strategy, choice of service providers, NAV frequency).

Preparation of constitutional and offering documents of the funds and preparation of agreements with fund’s service providers.

We provide for you:

- Directors

- Investment Managers

- Compliance Officer

- MLRO

- Administrator

- Auditor

Licence application process with the Malta Financial Service Authority.

Ongoing

Ongoing

-

Relation with the supervisory authority

-

Point of contact of all the fund’s service providers

-

Point of contact of fund’s promoter

-

Ongoing Supervision of the fund’s operations and performance

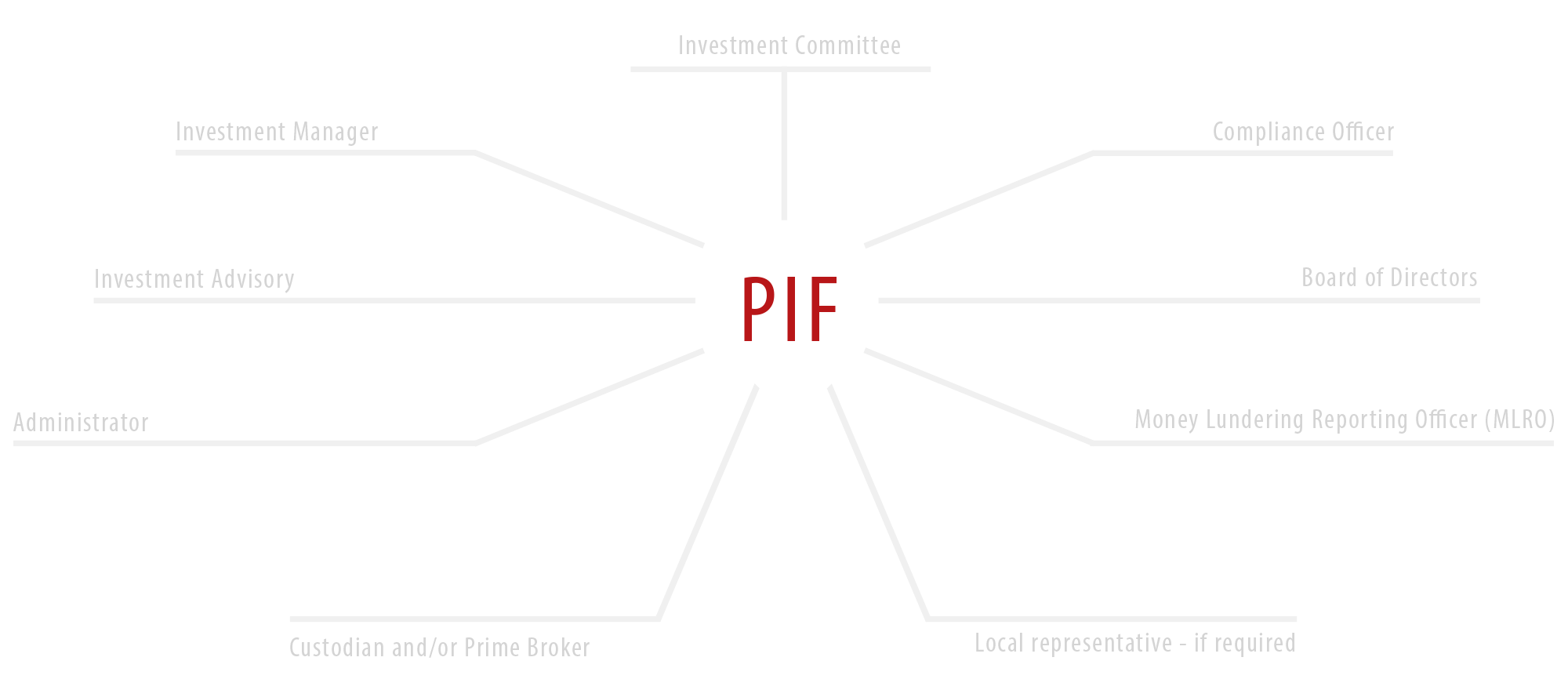

PIF

Professional Investor Funds

Professional Investor Funds

Legal Framework

Legal Framework

Investment Services and fund industries are regulated principally by the Investment Service Act, 1994 and its subsidiary legislation while the Malta Financial Services Authority (MFSA) is the single regulator for financial services in Malta. The Investment Service Act establishes also the regulatory framework for investment services providers such as portfolio managers, advisors, administrators, brokers and other financial service providers.

Overview

Overview

-

Professional Investor Funds (PIFs) are a special class of collective investment schemes which fall within the provisions of the Investment Services Act, 1994. These funds provide a “lighter” regulatory regime and more flexibility than UCITS and other retail funds but enjoy similar privileges as EU financial vehicles. PIFs are subject to minimal regulation compared to regular investment schemes provided that their only activity is operating as a PIF and does not itself carry out any further investment services licensable activity. A PIF falls under the AIFMD ‘de minimis’ regulation.

Professional Investor Funds have been extensively used for investment in non-traditional investments and/or specialist instruments including private equity, derivatives, immovable property / real estate, and traded endowment plans.

-

- No Investment Restrictions

- No borrowing or leverage restrictions

- Lighter regulatory regime

- More flexibility than retail funds

- EU Financial Vehicles

- Used for traditional and non-traditional investment (Real Estate, Private Equity, Alternative Investments)

- No Custodian Bank obligation

- Possibility of self-managed scheme

-

In the case of a non-prescribed fund, the fund’s income is exempt from tax in Malta (particular rules apply in the case of Income from immovable property situated in Malta).

(A Fund is classed as a prescribed fund if is formed under the laws of Malta and if the value of its assets situated in Malta amount to at least 85% of the value of the total assets;)

For Investors Not Residents in Malta:

- No Maltese withholding tax on dividends paid to non-residents

- No Maltese tax on capital gains for non-residents

-

A PIF may be promoted to those individuals or entities which are classified as a Qualifying Investors and satisfy certain eligibility criteria. Minimum Investment € 100'000.

Professional Investor Funds (PIFs) are a special class of collective investment schemes which fall within the provisions of the Investment Services Act, 1994. These funds provide a “lighter” regulatory regime and more flexibility than UCITS and other retail funds but enjoy similar privileges as EU financial vehicles. PIFs are subject to minimal regulation compared to regular investment schemes provided that their only activity is operating as a PIF and does not itself carry out any further investment services licensable activity. A PIF falls under the AIFMD ‘de minimis’ regulation.

Professional Investor Funds have been extensively used for investment in non-traditional investments and/or specialist instruments including private equity, derivatives, immovable property / real estate, and traded endowment plans.

- No Investment Restrictions

- No borrowing or leverage restrictions

- Lighter regulatory regime

- More flexibility than retail funds

- EU Financial Vehicles

- Used for traditional and non-traditional investment (Real Estate, Private Equity, Alternative Investments)

- No Custodian Bank obligation

- Possibility of self-managed scheme

In the case of a non-prescribed fund, the fund’s income is exempt from tax in Malta (particular rules apply in the case of Income from immovable property situated in Malta).

(A Fund is classed as a prescribed fund if is formed under the laws of Malta and if the value of its assets situated in Malta amount to at least 85% of the value of the total assets;)

For Investors Not Residents in Malta:

- No Maltese withholding tax on dividends paid to non-residents

- No Maltese tax on capital gains for non-residents

A PIF may be promoted to those individuals or entities which are classified as a Qualifying Investors and satisfy certain eligibility criteria. Minimum Investment € 100'000.

Functionaries and other services

Malta

Malta

The New Frontier of Wealth Management

Malta at a glance

Malta has officially been part of the European Union since 2004 and as a participant in the euro-zone guarantees automatic access to the market within the EU made up of more than 500 million people. Its strategic position enables rapid access from the main financial centres. Its political and economic stability make it possible for the Maltese government actively to support the development of the financial sector as a worldwide centre of excellence. The Maltese financial centre guarantees all the privileges of European membership, including compliance with the standards of European directives and hence the benefits deriving from having a European passport. While guaranteeing all the requirements for monitoring and prudence imposed by membership of the European Union, the Maltese financial sector is extremely accessible, with pro-active and business oriented domestic regulation.

Financial KeyFactors

- Competitive tax system;

- Competitive cost;

- Flexible legal and regulatory environment with a legislative framework in line with EU;

- An approachable and flexible regulator;

- Range of financial services available;

- Major International accountancy firms are present on the island

- High level of education (specific training in financial services is offered at various education levels);

Application and Licencing process

Application and Licencing process

-

Licence Application

- Preparation of draft offering document for the fund;

- MFSA feedback;

- Communication of the fund's intended activities;

- Provision of reply to MFSA Queries;

- If satisfied with the draft documentation provided, MFSA will issue its “in principle” approval subject to licence conditions;

- Applicant to finalize all outstanding matters and submit full application in final format;

- Issue of official Licence.

-

Post Licensing

The Applicant may be required to satisfy all post licensing matters prior to formal commencement of business.

-

Ongoing Supervising

- Ongoing supervision by the Securitiies & Market Supervision Unit;

- Day to Day Fund Trading;

- Periodic NAV issued by the Administrator;

- Ongoing supervision by the Board of Directors.

Once the fund is established, changes to the Offering Document must be approved by MFSA.

Licence Application

- Preparation of draft offering document for the fund;

- MFSA feedback;

- Communication of the fund's intended activities;

- Provision of reply to MFSA Queries;

- If satisfied with the draft documentation provided, MFSA will issue its “in principle” approval subject to licence conditions;

- Applicant to finalize all outstanding matters and submit full application in final format;

- Registration of company;

- Issue of official Licence.

Post Licensing

The Applicant may be required to satisfy all post licensing matters prior to formal commencement of business.

Ongoing Supervising

- Ongoing supervision by the Securitiies & Market Supervision Unit;

- Day to Day Fund Trading;

- Periodic NAV issued by the Administrator;

- Ongoing supervision by the Board of Directors.

The incorporation of the PIF may also require liaison with the Maltese Registrar of Companies. In the case of a SICAV, the Memorandum and Articles of Association (as approved by the MFSA) together with the relevant supporting documents and the applicable company registration fees will need to be submitted to the Registrar. Once the fund is established. Changes to the Offering Document must be approved by MFSA.

Contact us

For more informations, costs and personalised proposal.

For more informations, costs and personalised proposal.